Step Into The Future Of Car Insurance: Flexible Options For All Drivers

If you have been considering car insurance but have been turned off by confusing options and rising premiums, there is good news: modern car insurance solutions are changing the game. These updated policies not only offer a simpler and more flexible way to get covered, but they are also making quality protection more accessible than ever before.

The automotive insurance industry has undergone significant changes in recent years, moving away from rigid, traditional models toward more adaptable and personalized approaches. This shift reflects changing consumer expectations and technological advances that enable insurance providers to offer more nuanced coverage options. Today’s drivers benefit from insurance solutions that can adjust to their specific circumstances, driving patterns, and evolving needs throughout different life stages.

What Is Modern Car Insurance

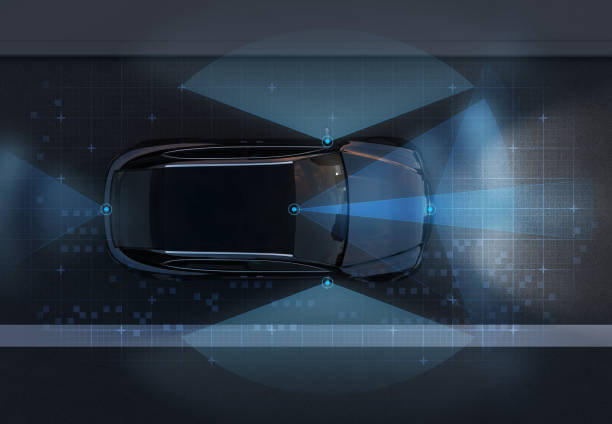

Modern car insurance represents a departure from conventional coverage models by incorporating technology-driven assessments, flexible payment structures, and customizable policy features. Unlike traditional insurance that relies primarily on demographic data and historical statistics, contemporary policies utilize telematics devices, smartphone apps, and IoT sensors to monitor actual driving behavior. This approach allows insurers to create more accurate risk profiles based on real-world data rather than broad generalizations. Modern policies often include features like usage-based pricing, where premiums reflect actual miles driven, and behavior-based discounts for safe driving practices such as smooth acceleration, gentle braking, and adherence to speed limits.

Why Are Flexible Car Insurance Plans Becoming A Popular Choice

Flexible car insurance plans have gained popularity due to their ability to accommodate diverse lifestyle needs and financial situations. Many drivers appreciate the opportunity to adjust their coverage levels seasonally, particularly those who drive less during certain months or store their vehicles during winter. Young drivers benefit from programs that reward good driving habits with premium reductions, while occasional drivers can opt for pay-per-mile options that eliminate the cost burden of traditional annual policies. Additionally, flexible plans often provide easier policy modification processes, allowing customers to add or remove coverage types, adjust deductibles, or modify payment schedules without lengthy administrative procedures. The transparency offered by these plans, where customers can see exactly how their driving behavior impacts their rates, has also contributed to their growing appeal.

How Do Today’s Smart Car Insurance Options Work

Smart car insurance options operate through sophisticated data collection and analysis systems that monitor various aspects of vehicle usage and driver behavior. Telematics devices installed in vehicles or smartphone applications track metrics such as mileage, time of day driving occurs, acceleration patterns, braking habits, and cornering behavior. This information is processed using advanced algorithms that assess risk levels and adjust premiums accordingly. Many smart insurance programs offer real-time feedback to drivers, providing insights into how specific behaviors affect their insurance costs. Some policies feature gamification elements, where safe driving earns points that can be redeemed for discounts or rewards. The integration of artificial intelligence allows these systems to continuously refine their assessments and provide increasingly accurate pricing models.

| Provider Type | Coverage Features | Cost Estimation |

|---|---|---|

| Traditional Full Coverage | Comprehensive, collision, liability | $1,200-$2,400 annually |

| Usage-Based Insurance | Pay-per-mile, telematics monitoring | $600-$1,800 annually |

| Snapshot Programs | Behavior-based discounts | $900-$2,100 annually |

| Digital-First Providers | App-based management, flexible terms | $800-$2,000 annually |

| Hybrid Policies | Traditional base with smart features | $1,000-$2,200 annually |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

The implementation of smart insurance technologies varies among providers, with some offering comprehensive telematics programs while others focus on specific aspects like mileage tracking or safe driving rewards. Many insurers now provide mobile applications that serve as central hubs for policy management, claims reporting, and performance monitoring. These apps often include features such as trip logging, driving score displays, and personalized recommendations for improving driving habits. The data collected through these systems not only influences pricing but also enables insurers to provide proactive safety alerts, maintenance reminders, and emergency assistance services.

The evolution toward flexible and smart car insurance options reflects broader trends in consumer preferences for personalized, technology-enhanced services. As autonomous vehicle technology continues to develop and transportation patterns evolve, insurance models will likely become even more sophisticated and adaptable. The current generation of flexible insurance options represents an important step toward more equitable and responsive coverage solutions that better serve the diverse needs of modern drivers while promoting safer driving behaviors through positive reinforcement and transparent pricing structures.