Safety Walk-In Tubs: Prices & Medicare Rules

Walk-in tubs are designed to provide easier and safer bathing experiences, especially for individuals with mobility concerns. Many homeowners explore these options to improve comfort and accessibility in their bathrooms. Understanding available features can help with planning.

Walk-in tubs aim to reduce slips and ease transfers, offering a seated bath with a low threshold and a watertight door. For many households in the United States, they are part of a broader home safety plan alongside grab bars, non-slip flooring, and adequate lighting. Understanding what they cost, which features matter, and how Medicare rules work can help you plan a project with fewer surprises.

What do walk-in tubs cost?

The price of a walk-in tub depends on the shell material, door design, size, and add-ons. As a general guide, basic soaking models often start around 2,000 to 3,500 dollars for the tub only. Mid-range units with heated surfaces or air jets may fall between 4,000 and 7,000 dollars for the tub. Premium hydrotherapy packages can exceed 8,000 dollars for the fixture alone. Installation by licensed trades typically adds 1,000 to 5,000 dollars, depending on plumbing or electrical upgrades, framing, and finish work in your area. These figures are estimates and can change based on brand, model, and labor rates.

Safety tubs: features that matter

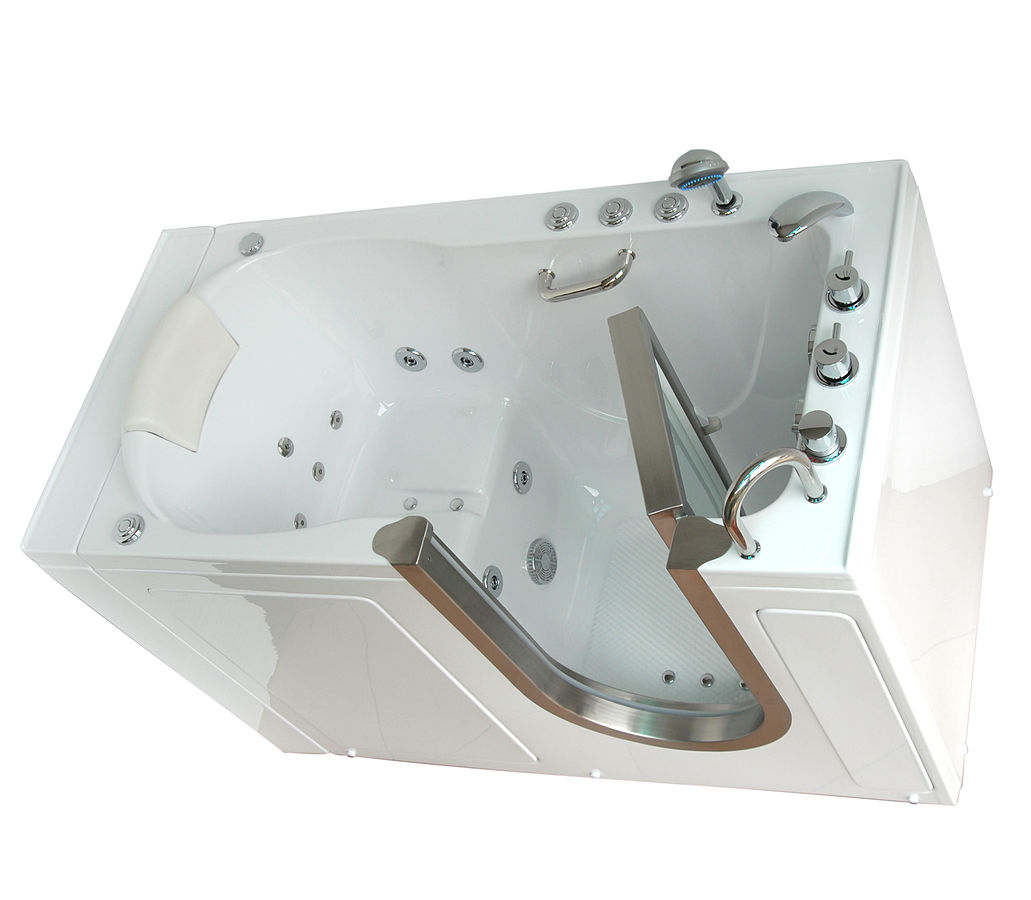

Safety tubs usually include a low step-in, textured floor, integrated seat, and grab points to improve stability. Look for anti-scald valves, easy-to-reach controls, and fast-fill and fast-drain systems to reduce time spent waiting in or out of water. A secure door seal is essential to prevent leaks, and an inline heater can help maintain comfortable water temperature. If massage is important, compare air versus water jets for maintenance needs and noise. Also consider your home’s water heater capacity and floor structure, since larger tubs may need more hot water and added floor reinforcement.

Medicare tub coverage explained

Original Medicare (Part A and Part B) generally does not cover walk-in tubs because they are classified as home modifications rather than durable medical equipment. A doctor’s note rarely changes this outcome. Medicare Supplement (Medigap) policies do not add coverage for these fixtures. Some Medicare Advantage (Part C) plans, however, may offer supplemental benefits that include certain bathroom safety improvements if the plan determines they are medically appropriate. These benefits vary by plan and location, often require prior authorization, and may use network contractors. Beneficiaries should review plan documents such as the Evidence of Coverage and speak with the plan before purchasing a tub. If a plan offers a home safety allowance, keep receipts and follow any documentation rules the plan specifies.

Senior bathtubs: choosing and planning

When selecting a senior-friendly bathtub, measure the doorways, hall turns, and bathroom layout to ensure the unit can be delivered and installed. Decide on inward- or outward-swinging doors based on mobility and available clearance. Check seat height, threshold dimensions, and handle placement for your body size and transfer method, and confirm that controls can be reached while seated. Ask local services about permitting requirements, GFCI protection, and any structural reinforcement. Plan for maintenance access to pumps and drains, and confirm warranty terms for the shell, door seal, and mechanical components.

To understand market pricing, here is a comparison of well-known providers with estimated costs for common configurations installed by licensed contractors in your area.

| Product/Service | Provider | Cost Estimation |

|---|---|---|

| Walk-in Soaking Tub | American Standard | $4,000–$8,500 installed |

| Walk-In Tub with Hydrotherapy | Safe Step | $10,000–$15,000 installed |

| Walk-In Bath | Kohler | $8,000–$20,000 installed |

| Acrylic Walk-In Tub | Ella’s Bubbles | $6,000–$12,000 installed |

| Outward-Opening Door Tub | Boca | $8,000–$14,000 installed |

| Walk-In Tub Package | Jacuzzi | $6,000–$12,000 installed |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Practical cost factors and budgeting

Total project price reflects more than the tub sticker price. Homes with older plumbing may need new supply lines, drains, or a larger water heater to support full, hot fills. Electrical upgrades for pumps or heated surfaces can add to labor. Tile repair, trim carpentry, and waterproofing affect finish costs. Some households prefer replacing a tub-shower combo with a tub and separate shower; that scope increases time and materials. Many brands offer financing and multi-year warranties, but terms vary and can change. Ask for itemized quotes that separate the fixture from installation and verify warranty coverage for door seals and mechanical parts.

Understanding alternatives

If stepping over a threshold remains difficult even with a walk-in design, consider a low-threshold shower with a sturdy seat, handheld showerhead, and multiple grab bars. Showers generally have shorter wait times because there is no need to fill or drain a basin, which some users find more convenient. For those who value soaking for comfort, a walk-in tub may still be appropriate, but factor in the time to enter, fill, and drain, as well as water use and energy consumption.

Documentation and safety planning

If you intend to pursue potential plan benefits, collect documentation that supports medical need, such as notes on mobility limitations and fall risk. Even without coverage, keep detailed records: the model number, installation permits, contractor license, warranties, and maintenance schedule. Pair the new fixture with good lighting, non-slip mats outside the bath, and accessible storage so essentials are within reach. Periodically test the GFCI, verify that drains clear quickly, and check the door seal for wear.

Conclusion

Walk-in tubs can improve bathing safety and comfort when chosen and installed thoughtfully. Costs vary with features and site conditions, and while Original Medicare rarely pays for these fixtures, some Medicare Advantage plans may offer limited support under specific supplemental benefits. Careful planning, realistic budgeting, and a clear reading of plan rules help households make an informed decision.